Introduction

The solar industry has reached a pivotal moment in its evolution. Once viewed as a niche upgrade for the environmentally conscious, solar power has become a mainstream home improvement driven by both necessity and innovation.

With electricity prices climbing, grid reliability under increasing strain, and sustainability emerging as a top household priority, homeowners across the country are rethinking how they power their lives. For many, solar represents more than a cost-saving measure — it’s a statement about energy independence, resilience, and long-term financial security.

Yet despite record growth in solar adoption nationwide, questions persist. Homeowners still weigh installation costs against potential savings, debate the impact on property aesthetics, and look for reassurance that the technology and incentives will deliver on their promises.

To better understand these perceptions, SolarTech surveyed 2,000 U.S. single-family homeowners to uncover what’s driving interest in solar, what’s holding others back, and how these attitudes are shaping the future of residential energy.

Solar Momentum Builds: Why Homeowners Are Embracing Energy Independence

First, we set out to understand the current landscape of residential solar adoption — who has it, who’s considering it, and what’s driving interest. By exploring confidence levels, savings expectations, and underlying motivations, these insights reveal how homeowners think about solar in 2025 and what’s fueling the next wave of adoption.

Solar adoption and consideration remain strong

When asked whether they currently have solar panels installed, 18% of homeowners reported already having solar, while another 52% said they are considering it within the next five years — 25% within the next year and 27% within two to five years.

Only 29% indicated they are not currently considering solar at all. This means that more than seven in ten homeowners nationwide are either active participants in or potential entrants to the solar market — a clear signal of ongoing momentum for residential installations.

Homeowners expect tangible reductions in their monthly bills

For most respondents, solar’s appeal begins with its promise of savings. The majority of homeowners (61%) believe solar can reduce monthly electricity bills by more than 10%, with nearly one in four (23%) expecting a reduction of 26–50% and another 13% expecting savings greater than 50%. Only 7% think solar would have no impact on their bills.

These findings reinforce that cost savings remain the central value proposition for solar and that consumer expectations around payback and efficiency are rising alongside awareness.

Confidence in long-term payoff is growing

Financial confidence in solar continues to trend upward. Nearly half of homeowners (49%) said they are confident or very confident that a solar investment will fully pay for itself over time, compared to just 32% who expressed little or no confidence.

This growing belief in solar’s financial return reflects both improving technology and greater public familiarity with financing options such as tax incentives, rebates, and low-interest loans.

Lower energy costs dominate as the top motivation

When asked why homeowners are drawn to solar, one theme stood out clearly: saving money. More than half (51%) cited lower energy costs as their primary motivation for adopting solar. Energy independence and reduced reliance on utilities ranked second (21%), while environmental responsibility came in third at 15%.

Only small portions of respondents said they were primarily motivated by available incentives (6%) or neighbor influence (2%). The data confirms what many in the industry already know — solar’s appeal is now driven more by economics than ideology.

The latest data from the International Renewable Energy Agency (IRENA) and other authoritative sources reveals striking cost advantages for renewable technologies:

Solar ownership represents a sense of empowerment

Beyond finances, homeowners increasingly see solar as a symbol of independence and control. When presented with the statement, “Owning solar feels like taking control back from the city and utility companies,” two-thirds (66%) agreed or strongly agreed. Only 9% disagreed, while 25% remained neutral.

This sentiment underscores an important psychological driver: as energy costs and reliability concerns rise, solar isn’t just viewed as an upgrade — it’s viewed as empowerment.

What this means for the solar market

Taken together, these results paint a clear picture of growing confidence and maturing consumer attitudes toward solar energy. Adoption intent remains high, financial expectations are strong, and homeowners increasingly associate solar with autonomy rather than risk. While economic incentives remain a key driver, the emotional dimension — control, security, and independence — is emerging as an equally powerful motivator.

For solar providers, these insights highlight a dual opportunity: to reinforce the financial case for solar with clear, transparent ROI education, and to tap into the deeper emotional story of energy freedom that clearly resonates with modern homeowners.

What’s Holding Homeowners Back? Breaking Down the Real Barriers to Solar Adoption

Even as solar adoption rises, not every homeowner is ready to make the switch. To understand what’s slowing broader adoption, the survey explored the financial, emotional, and practical barriers that still hold many back.

The findings reveal that while the benefits of solar are widely recognized, perception gaps around cost, confidence, and convenience remain powerful deterrents for a portion of the market.

Cost continues to be the most significant hurdle

When asked why some homeowners have yet to install solar, more than half (57%) pointed to up-front installation costs as the primary barrier. This response far outweighed any other concern, underscoring that affordability remains the industry’s biggest challenge.

Although federal and state incentives have made solar more attainable, many homeowners still perceive the initial investment as prohibitive — suggesting a continued need for clear communication around financing options, payback periods, and total lifetime savings.

Financial uncertainty fuels hesitation

In addition to cost, uncertainty about savings or return on investment was cited by 13% of respondents, while another 15% mentioned maintenance or reliability concerns. Collectively, these concerns reveal a lingering skepticism about whether solar systems truly deliver the long-term value promised.

Nearly two-thirds (62%) of homeowners expressed at least some concern that solar may not provide the level of financial savings they expect, showing that education on real-world performance and transparency around warranties can play a major role in closing this confidence gap.

Aesthetic reservations remain—but are less pronounced

While cost and confidence dominate the discussion, aesthetic concerns also factor in for a minority of homeowners. Only 9% strongly agree that solar hurts curb appeal, while 45% disagree, indicating that improvements in modern panel design and integrated roofing solutions are successfully reshaping how solar fits into the look of the home.

This shift suggests the conversation has evolved from “Will solar make my house look bad?” to “Can I make solar look good on my home?” — a sign of cultural progress for the industry.

Trust and education drive future opportunity

When asked what would most motivate homeowners to install solar, nearly half (47%) said lower installation costs or better financing, followed by better information about potential savings (18%) and education about future energy and climate trends (11%).

These results point to a clear opportunity: while homeowners want to go solar, they need more clarity and confidence. Simplified financing tools, transparent ROI calculators, and trustworthy local installers can go a long way toward converting interest into action.

The takeaway for the solar market

The data confirms that the industry’s biggest obstacles aren’t about technology — they’re about perception. Homeowners overwhelmingly understand solar’s potential, but cost, confusion, and credibility gaps still slow adoption.

Addressing these issues with clear, data-driven messaging and accessible financing can help bridge the divide between interest and installation. As economic pressures and energy instability continue to rise, the companies that communicate trust and transparency will be the ones that move hesitant homeowners toward making the switch.

From Upgrade to Asset: How Solar Is Shaping the Future of Home Value

As solar adoption expands, one of the most important questions for homeowners — and for the real estate market as a whole — is how solar impacts a home’s value.

Beyond monthly energy savings, homeowners increasingly view solar as an investment that can strengthen their property’s financial position. This section explores those perceptions and what they reveal about how solar is reshaping the definition of a “modern, high-value home.”

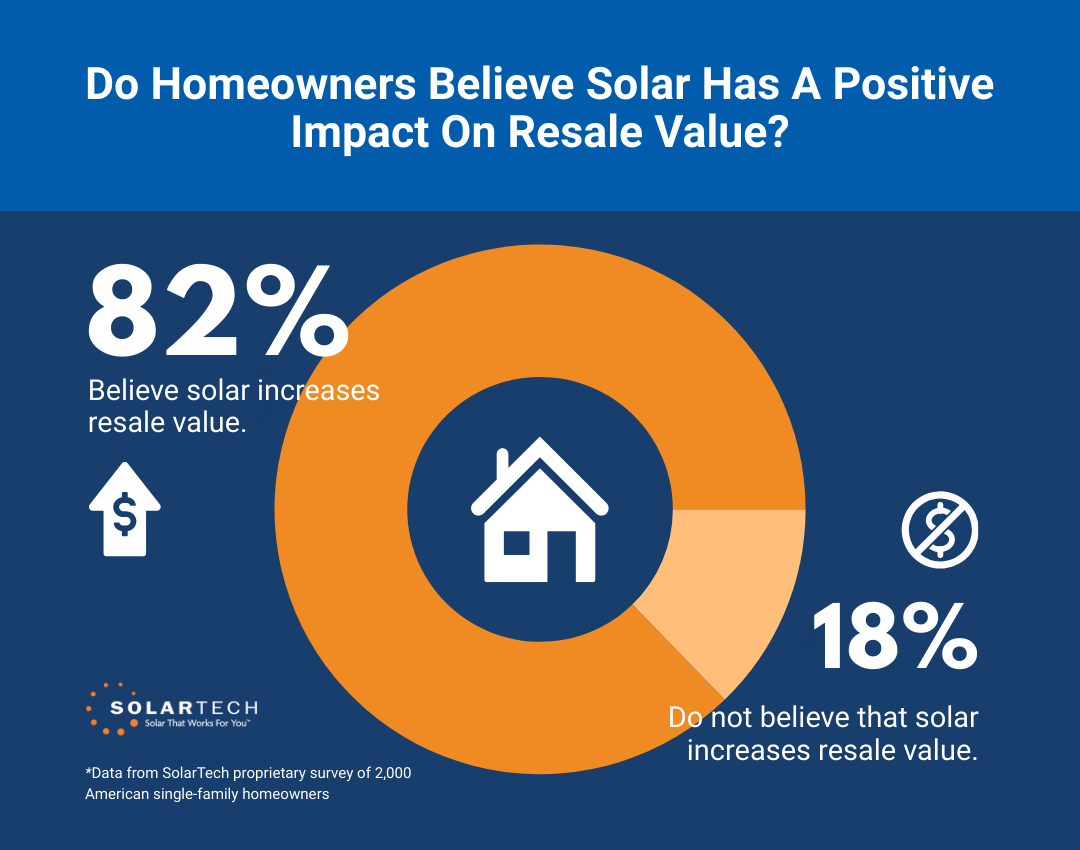

Most homeowners see solar as a value booster

The vast majority of homeowners believe solar panels add meaningful value to a property. Just 18% said solar does not increase home value, while more than half (55%) estimated an increase of 6% or more, including 21% who believe the boost could exceed 10%.

This optimism reflects a growing belief that solar installations are not simply energy features, but permanent home upgrades — similar to kitchen remodels or smart home systems. For the real estate industry, these perceptions suggest that buyers and sellers alike now view energy efficiency as a key factor in evaluating property worth.

Buyers prefer homes with solar already installed

Solar’s influence extends to buyer behavior as well. More than half of homeowners (55%) said they would be more likely to purchase a home that already has solar installed, with 19% saying much more likely and 36% saying somewhat more likely. Only 11% said they’d be less likely to buy a solar home.

This trend signals a shift in how buyers interpret sustainability and long-term savings; for many, the presence of solar offers reassurance that the home is future-ready and energy efficient.

The takeaway for the housing and solar markets

The data makes clear that solar has transitioned from a “nice-to-have” amenity to a defining feature of home equity. Homeowners increasingly associate solar with higher resale value, faster sales, and greater buyer appeal — all of which reinforce the financial case for adoption.

Solar’s Next Chapter: Rising Costs, Energy Resilience, and the Road Ahead

While the early sections of this report focus on current adoption and barriers, the final part of the survey looks forward — exploring how homeowners perceive solar’s future in a world of rising energy costs, climate concerns, and evolving technology. The data paints a picture of cautious optimism: most homeowners believe solar is a smart, timely investment, though skepticism and uncertainty persist among a smaller but notable minority.

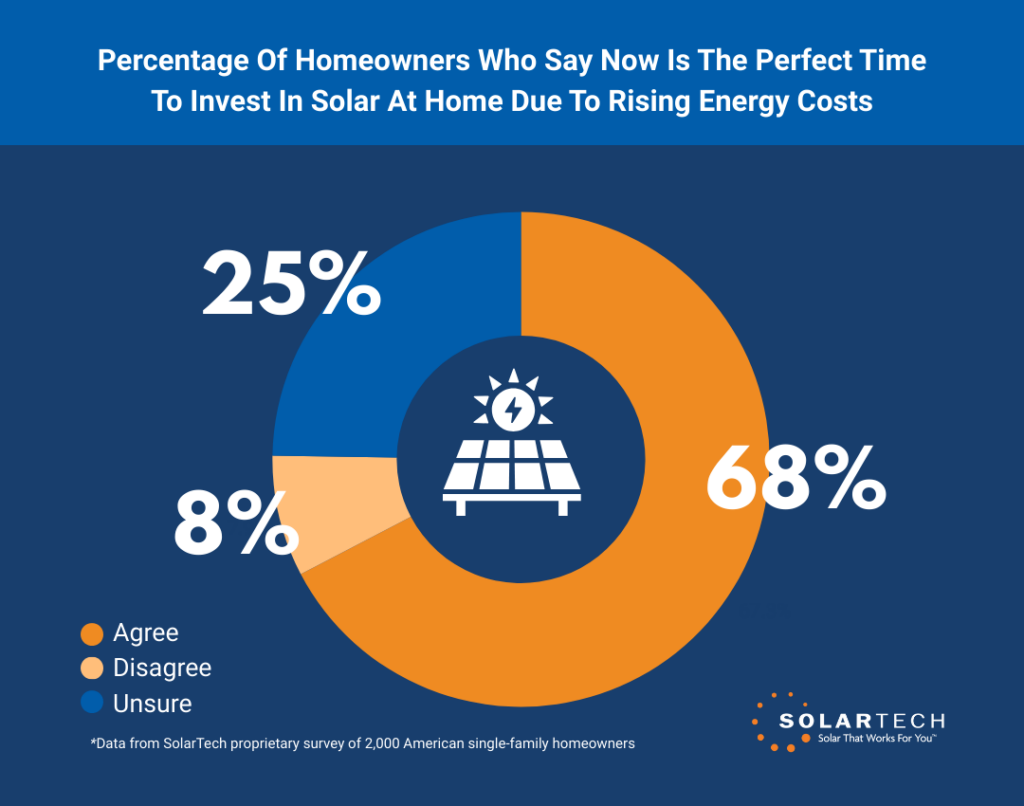

Rising energy prices are fueling stronger interest in solar

For many homeowners, solar has become less of an environmental choice and more of a financial strategy. When asked whether rising energy prices make solar a smarter investment now than ever before, 68% agreed or strongly agreed, while only 8% disagreed. Another 25% remained neutral.

This overwhelming majority suggests that utility inflation is reshaping how people view solar — not as a luxury or long-term aspiration, but as an immediate hedge against unpredictable energy costs.

Solar’s reputation remains largely positive — but not universal

Public sentiment toward solar remains overwhelmingly favorable, though not without nuance. A combined 60% of homeowners describe the solar movement as either a smart financial and environmental decision (42%) or a necessary step to fight climate change (18%). However, 14% see it as a government-backed trend that benefits companies more than homeowners, while 8% dismiss it as a passing fad.

These mixed perceptions reveal that while solar’s mainstream credibility is solid, the industry still has work to do in communicating long-term reliability, transparency, and fairness to consumers.

Grid concerns are shaping homeowner attitudes

Another key theme emerging from the data is concern over the reliability of the traditional power grid. Nearly four in ten homeowners (40%) describe themselves as moderately to extremely concerned about the grid’s ability to meet their energy needs within the next five years, while only 22% say they are not concerned at all.

This anxiety aligns with the growing public awareness of grid instability, power outages, and regional blackouts — factors that increasingly make solar (and solar-plus-battery systems) more appealing to security-minded homeowners.

Blackouts and reliability fears are driving future intent

When presented with the statement, “If major blackouts continue to become more common, I would be much more likely to install solar in the next five years,” 64% agreed or strongly agreed. Only 9% disagreed, with the remaining 26% neutral.

This finding suggests that the conversation around solar is evolving from “How much can I save?” to “How can I protect my home from energy uncertainty?” Energy resilience — once a secondary benefit — is quickly becoming one of solar’s strongest selling points.

The takeaway for the solar market

The data indicates a clear and optimistic trajectory for residential solar. Rising costs, grid instability, and shifting homeowner values are converging to create a strong foundation for growth through 2025 and beyond.

The Future Is Bright: How Solar Will Power the Next Generation of Homeowners

The data from this year’s survey tells a clear story: solar power is no longer an emerging technology or a niche lifestyle choice — it’s an essential part of the modern homeowner’s conversation about cost, comfort, and control. Across demographics, the majority of homeowners recognize solar’s financial and environmental benefits, and interest in adoption remains strong.

At the same time, the findings reveal areas of opportunity. Upfront cost and perceived complexity continue to deter some homeowners, while others remain uncertain about long-term returns.

These insights point to a powerful challenge for the solar industry in 2026: not convincing homeowners why solar matters, but showing them how to make it work for their household — with transparent pricing, flexible financing, and trusted local partnerships.

For the real estate market, solar’s growing association with higher home value and buyer appeal marks a major shift in how we define property worth. What was once considered a “bonus feature” is becoming an expectation. As energy-efficient homes command greater attention from buyers, solar will increasingly factor into resale value, appraisals, and overall market competitiveness.

Looking ahead, 2026 will bring continued innovation — from better-integrated panel designs to smarter, AI-powered home energy management systems. Just as importantly, it will bring a cultural evolution: a widening understanding that solar isn’t only about saving money, but about self-reliance and sustainability. The next frontier will be ensuring that every homeowner, regardless of income or region, feels empowered to take part in that transition.

For SolarTech and the broader industry, the path forward is bright. By combining education, accessibility, and cutting-edge technology, solar can continue to move from aspiration to everyday reality — helping homeowners achieve energy independence while contributing to a cleaner, more resilient future.

Methodology

All data presented in this report is derived from a survey conducted by SolarTech via the online survey platform Pollfish from October 16–22, 2025. In total, 2,000 U.S. adults who own single-family homes were surveyed. Respondents were screened using Pollfish’s homeownership and demographic filtering features to ensure all participants were verified homeowners. The survey included a nationally representative mix of homeowners — both those who currently have solar and those who do not. All respondents were asked to answer each question truthfully and to the best of their knowledge and abilities.