Timeline of Upcoming Changes

The Future of Solar and Electricity Has Several Changes In Store.

Read On To Become Informed of These Substantial Changes To Come!

Dwindling Incentive Programs

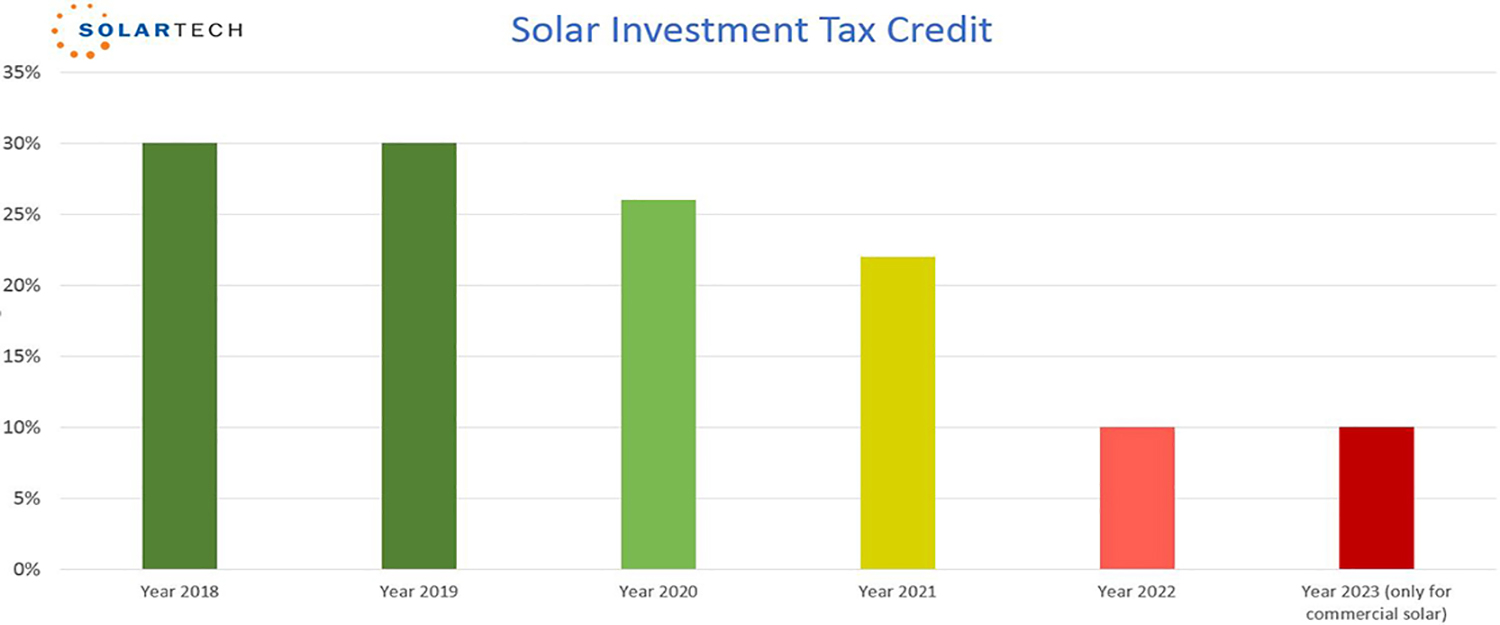

As you can see from the graph, getting a solar energy system installed is way more beneficial sooner than later. The federal government will be offering:

- The maximum 30% tax credit during 2018 and 2019.

- It will drop to 26% in 2020, 22% in 2021, and bottoming out at 10% in 2022 for consumers.

- After 2023, this 10% tax credit will no longer be available for homeowners and will only provide the tax credit for commercial solar customers.

This tax credit allows up to 30% of the total cost of the system. If you have a huge tax bill, the credit can be taken all at once or you can utilize the credit over multiple years. For example, if your solar panel system costs $18,000, a 30% tax credit would be $5,400. If you owe $4,000 in taxes for 2019, your tax bill will be reduced to zero, with a remaining $1,400 tax credit for your 2020 and future returns.

Rate Increases & Time Of Use Conversi

This graph depicts the SDGE new time of use (TOU) rate system. These high prices will be going up even higher soon. Electricity costs in San Diego are proposed to rise by 11 percent in 2019, and an additional 7.13 percent in 2020, 5.11 percent in 2021, and 4.99 percent in 2022. Now is a better time than ever to invest in solar panels to avoid paying the electricity premium.

Solar panels have the capability to save you money by reducing your utilities/energy costs along with several other benefits such as:

- Zero-down financing options available that are significantly lower than your monthly electricity bill.

- Going solar can nearly eliminate or significantly reduce your electric bill.

- The system will pay for itself typically within 3-5 years, the rest of the duration will be a return on your investment.

- Renewable clean energy reduces reliance on fossil fuels.

Solar Mandate 2020

In 2020, all newly built houses in California will require solar panels! This mandate will apply to new single-family homes and new multi-family homes of three stories or fewer. Builders who obtain construction permits issued on Jan. 1, 2020 or later must comply.

The mandate will advance the state of California towards its clean energy goals and help make solar panels more accessible to new home market consumers. This will save the homeowner thousands of dollars that would be otherwise paid to the electricity company.

Beat The Rush

With the tax credit stepping down after 2019, there will be a significant increase in demand for solar throughout the next year. All solar installers will be busy, especially quality companies like SolarTech.

If you are a person who likes to receive maximum benefit and value, DON’T HESITATE and contact us today for a free quote!